Introduction: Why Customers Felt Cheated

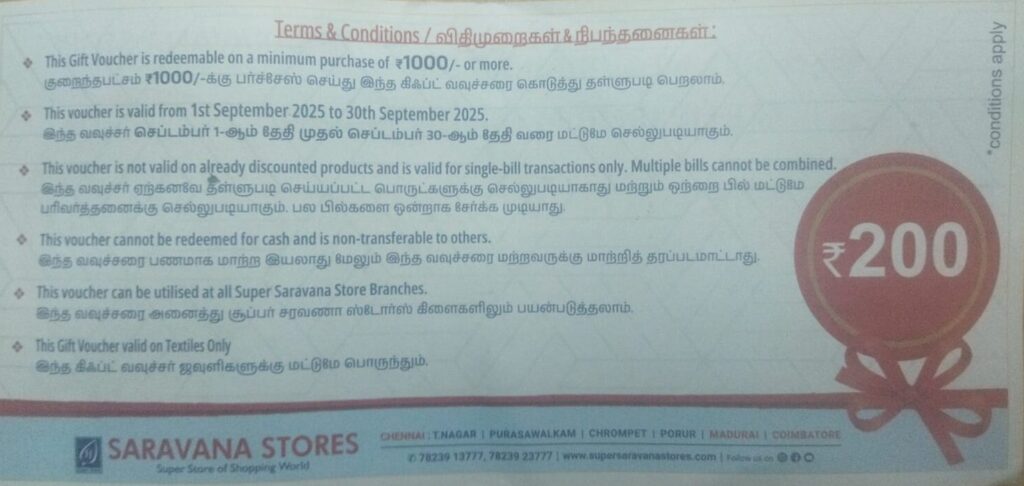

In Tamil Nadu, Saravana Stores is a household name. Known for its massive outlets, competitive pricing, and endless product variety, the brand has built a strong reputation among middle-class shoppers. Recently, however, a promotional campaign caused confusion and disappointment among customers: the famous ₹200 coupon scheme.

At first glance, it looked like a generous deal. For every ₹1000 spent in August, shoppers received a ₹200 coupon. A family spending ₹8000 in one visit walked out with ₹1600 worth of coupons. Naturally, they assumed that in September, they would enjoy ₹1600 straight off their next bill.

But when September came, the fine print became unavoidable. The rule was that customers could use only one ₹200 coupon per ₹1000 spent in September. In other words, to use all eight coupons (₹1600 worth), the family had to spend another ₹8000 in September.

This discovery left many shoppers feeling misled. Social media posts accused Saravana of “cheating” customers. But when analyzed carefully, the scheme was not fraudulent. It was a classic example of conditional redemption marketing—a tactic widely used in the retail world to increase repeat purchases.

Section 1: How the Coupon Scheme Works

Let’s break it down step by step.

Step 1: August Shopping

Spend ₹1000 → Get one ₹200 coupon.

Spend ₹8000 → Get eight coupons worth ₹1600 in total.

Step 2: September Redemption

For every ₹1000 spent, only one coupon can be redeemed.

Examples:

Spend ₹1000 → Use 1 coupon = ₹200 discount.

Spend ₹3000 → Use 3 coupons = ₹600 discount.

Spend ₹8000 → Use all 8 coupons = ₹1600 discount.

The Catch

You cannot simply walk in and claim ₹1600 off without another large purchase.

The total value of your coupons depends on repeating the same spending pattern as the previous month.

Section 2: Why Customers Felt Misled

The disappointment stems from expectation vs. reality.

Expectation: “If I spend ₹8000 today, I get ₹1600 off my next bill.”

Reality: “If I spend ₹8000 today, I must spend another ₹8000 next month to get ₹1600 off.”

Key Reasons for Misunderstanding

Headline Marketing

Ads focused on “₹200 coupon per ₹1000 spent” but didn’t emphasize the redemption rule.

Lack of Transparency

The restriction (1 coupon per ₹1000) was printed in fine print, not in bold communication.

Customer Psychology

Coupons feel like “free cash.” Customers naturally assumed they could stack them freely.

Mismatch of Timing

Not all customers wanted to spend heavily in consecutive months.

This gap in communication led to anger and the feeling of being cheated.

Section 3: Business Perspective – Why Saravana Designed It This Way

From Saravana Stores’ viewpoint, this scheme is strategic, not deceptive.

1. Driving Repeat Purchases

Instead of giving an instant discount, the coupon forces customers to return the next month. This ensures consistent sales.

2. Matching Revenue to Rewards

If customers could redeem all coupons at once, Saravana would face a steep discount hit. By limiting redemption, they control their costs.

3. Increasing Basket Size

When customers come back to redeem coupons, they rarely stop at the minimum ₹1000. The scheme encourages larger purchases.

4. Creating Loyalty

The coupon psychologically ties customers to the brand. Throwing away unused coupons feels like a waste, so customers return to Saravana instead of competitors.

In short, the scheme is designed to balance customer benefit with business profitability.

Section 4: The Psychology of Coupons

Coupons are one of the oldest tricks in the retail playbook. Why do they work so well?

Loss Aversion

Shoppers hate losing value. Once you hold ₹1600 worth of coupons, the idea of not using them feels like a financial loss.

Illusion of Savings

Even a small discount feels powerful. A ₹200 coupon might be less than 3% on a large bill, but it still creates satisfaction.

Commitment Bias

Once you’ve shopped at Saravana and earned coupons, you feel invested. You’re more likely to return to “complete the deal.”

Deferred Gratification

By delaying the reward to the next month, Saravana stretches out the shopping cycle and creates a habit loop.

Section 5: Comparison With Other Retail Marketing Tactics

Saravana is not alone in using such strategies. Globally, retailers use similar tactics.

Big Bazaar Profit Club

Customers paid ₹8000 upfront and got shopping worth ₹10,000. The catch? They could use only ₹1000 worth per month, locking them in for 10 months.

Reliance Smart Coupons

Reliance often gives “₹250 off on next purchase above ₹2000.” Like Saravana’s coupon, the reward depends on spending more.

Amazon & Flipkart Cashbacks

Cashback is often credited as wallet balance or gift cards, usable only on future purchases, not as instant savings.

Starbucks Rewards

Stars earned today can only be redeemed later, ensuring repeat visits.

The formula is universal: “Reward today, but redeem tomorrow—if you spend more.”

Section 6: Is This Cheating?

Legally and ethically, Saravana is not cheating.

The coupons are real.

The terms are defined (though not clearly highlighted).

Customers do get value, but under conditions.

The problem lies in marketing communication. When conditions are hidden or minimized, customers feel misled. Transparency is the missing link here.

Section 7: Impact on Customers

The Pros

Regular Saravana shoppers genuinely benefit.

If you planned big purchases across months, you save a good amount.

Loyal customers get more incentive to stay with the brand.

The Cons

Occasional shoppers feel tricked, as they may never use all coupons.

The scheme pressures customers into spending more than planned.

The psychological effect of “forced loyalty” can cause frustration.

Section 8: Impact on Saravana Stores

Short-Term Benefits

Higher footfall in consecutive months.

Increased sales volume.

Stronger brand recall through promotions.

Long-Term Risks

Negative customer perception if communication isn’t clear.

Social media backlash labeling the store as “cheating.”

Risk of eroding trust if customers feel manipulated.

Section 9: How Customers Can Play Smart

Shoppers can still make the most of such schemes by planning carefully.

Break Up Purchases

Instead of buying everything in one month, split purchases across August and September to maximize coupon redemption.

Use for Essentials

Buy groceries, clothes, or home items you need anyway, so the discount becomes real savings, not forced spending.

Avoid Overspending

Don’t let the coupon trick you into buying things you don’t need. Remember: saving ₹200 on an unnecessary ₹1000 spend is not a real saving.

Section 10: Business Lessons From the Campaign

Saravana’s coupon strategy shows both the power and pitfalls of retail marketing.

Power: Smart promotions can double sales, lock in customers, and create buzz.

Pitfall: Poor communication can turn a clever strategy into a PR headache.

If Saravana had explained clearly—“Spend ₹1000 this month, get ₹200 off on every ₹1000 you spend next month”—customers would have understood and accepted the logic. Transparency is the difference between “smart marketing” and “cheating” in the eyes of the consumer.

Conclusion: Not Cheating, Just Marketing

The Saravana Stores ₹200 coupon scheme is not fraud. It’s a structured loyalty tactic. Customers who understood the rules and planned accordingly gained real value. Customers who expected instant, unrestricted discounts felt cheated.

The truth lies in the middle:

Saravana is not lying, but they communicated poorly.

Customers are not wrong to feel misled, but the scheme is still legitimate.

At its core, this is a marketing trap—not illegal, not unethical, but designed to maximize repeat purchases. For businesses, it’s an example of how strategic offers can drive growth. For customers, it’s a reminder: always read the fine print, and never confuse coupons with cash.

For every ₹1000 you spend at Saravana Stores in August, you receive a ₹200 coupon. These coupons can be redeemed in September, but only one coupon can be used per ₹1000 spent.

No. You can use only one ₹200 coupon for every ₹1000 you spend in September. For example, if you got 8 coupons worth ₹1600, you need to spend another ₹8000 in September to redeem the full amount.

Many customers assumed the coupons worked like instant cash discounts or could be fully redeemed at once. When they discovered the restriction (1 coupon per ₹1000 spent next month), they felt misled.

No. The coupons are genuine, and the discounts are real. However, the terms and conditions were not highlighted clearly, which caused confusion. It is a marketing tactic, not fraud.

If you don’t shop in September, your coupons will expire and cannot be used later. The scheme is designed to encourage customers to return within the set period.

Plan your shopping across two months. For example, buy some items in August to earn coupons, then save essential purchases for September so you can redeem them. This way, you get real savings without overspending.

This type of promotion ensures repeat customer visits, increases monthly sales, and creates customer loyalty. It’s a common retail strategy used worldwide by supermarkets, e-commerce platforms, and big brands.